[ad_1]

Introduction:

The People’s Republic of China, herein China, is rapidly becoming one of the most important countries in which to do business. It has accomplished a great deal in a short period of time, including developing two major domestic stock exchanges over the past twenty years, and garnishing entry into the World Trade Organization (WTO). China’s economic modernization has lifted nearly 400 million Chinese out of poverty since 1990. Sadly, 415 million citizens still live on less than $2 per day. China has one of the most open countries in which goods flow freely to and from the country. However, the country also consistently ranks as one of the least politically free in the world. China is the first poor global superpower in history: It is the fourth-largest economy, yet its per capita income is ranked around 100th in the world.

Rise of China as a Superpower:

The phrase ‘Made in China’ has become as universal as money itself. China has progressed technologically over the past few decades in terms of the goods it produces. This nation sews more clothes, stitches more shoes and assembles more toys than any other nation. China is also the world’s largest maker of consumer electronics, including TVs, DVDs and cell phones. Furthermore, they are moving quickly into biotechnology (biotech) and computer manufacturing. Lastly, China makes parts for Boeing 757s and is exploring space with its own domestically built rockets. In terms of trade, China is one of two main sources of imports to the Eurozone area, with shares of over 10%. These levels are below that of the United Kingdom (UK), but are above the share of imports by the United States (US). This makes China a direct competitor of mature economies.

China is the largest market in the world, containing one-fifth of the world’s population. Over 100 cities in China have populations of one million people or more. In comparison, the U.S. has nine cities with such a population; Western and Eastern Europe combined has thirty-six of that size. Customers in China do business with household names, such as Citibank, Disney, General Electric (GE), Toyota and Microsoft.

Foreign direct investment (FDI) in China has been very impressive in recent years. Shanghai, China’s most populous city and foremost financial hub, attracted $12 billion alone in FDI in 2004 for industries that export mainly to the U.S. By the end of 2003, 14,400 wholly owned foreign companies were in the city with another 13,000 underwritten with foreign money. Shanghai, alone, attracted approximately the same level of investment as all of Indonesia and Mexico combined. There have been both successes and failures in efforts by firms to enter the Chinese marketplace. For instance, Unilever launched fourteen joint ventures in China from 1986 through 1999 and was in the red most of the time. In contrast, Proctor and Gamble (P&G) ended up as a market leader in almost all categories they introduced in China.

By the end of 2002, just one year after joining the WTO, China overtook the U.S. in FDI inflows. China became the 143rd member of the WTO on December 11, 2001, after nearly fifteen years of negotiating the terms of its entry. China agreed to substantially reduce its tariffs on agricultural and industrial goods, to limit subsidies on agricultural production and forgo state monopolization of international trade in grain. Also, the country agreed to enforce property rights for intellectual property, open up its service sector to foreigners and remove restrictions on trading and distribution for most products. In return, China received permanent most-favored-nation status with the US and gained access to WTO dispute-settlement mechanisms to protect trade interests and participate in multilateral negotiations on trade rules and future trade liberalization. China is expected to become more productive over the years as it adjusts to world prices.

China’s labor force is larger than the sum of all labor forces in developing countries. The unemployment rate in urban settings is currently 4.5% and is usually isolated among newcomers to the urban labor force. Chinese cities currently create a combined total of around eight million new jobs per year. The entry into the WTO inevitably led to the displacement of millions of workers at inefficient state-owned factories. The economy must grow at a rate that will absorb these workers and find them new jobs. Slower economic growth could lead to social unrest and displacement of Chinese leadership.

China’s export and import of merchandise and services has grown substantially over the years. China is also a key outward investor: China is the world’s largest holder of foreign reserves, at $853.7 billion at the end of February 2006. FDI has also contributed to a technology transfer in China, leading to such things as production of aforementioned technology-driven goods. According to the International Monetary Fund’s (IMF) World Economic Outlook database, China’s current account surplus, since 2004, is expected to continue to increase. By 2005, it had reached 7.5%. China has five firms in the top fifty transnational corporations from developing countries over the period of 2002 through 2004. More than 50% of FDI in China is held on offshore centers, such as Hong Kong.

China is poorly endowed with natural resources, with the exception of coal. It is becoming increasingly dependent on imports of petroleum and other natural resources. China’s energy consumption grew 80% from 1995 to 2005, and its share of world energy consumption over that time frame increased from 9% to 12%. As of 2002, China was the number two oil consumer after the U.S. and now relies on imports to meet almost half of its oil demand. It goes without saying that both countries share an interest in a stable Middle East to provide a significant quantity of oil to their sovereign nations.

State of China’s Financial Markets:

In 1992, investment by foreigners in the Chinese stock market was permitted through multiple share classes. Access, however is still restricted and there is limited attractiveness due to the significance of the state-owned shares. Debt inflows are also heavily restricted, as have been private capital outflows. Bank deposits to GDP rose almost three-fold between 1991 and 2004; the banking sector remains excessively focused on lending to state-owned enterprises (SOEs), however, and is not an adequate provider of credit to private enterprises and households. Bank loans accounted for approximately 20% of firm financing. Stock and bond issuance played only a minor role. Poor intellectual property rights in China means that much of inward FDI is confined to labor-intensive sectors that do not rely on proprietary technologies. This situation is slowly being addressed and corrected since China’s admission into the WTO.

As of 2004, 64% of all shares in the Chinese stock markets were non-negotiable, government-owned shares. These shares are not priced, and therefore, central governments tend to be indifferent toward the financial conditions of the enterprises in which it has control. In April 2005, the government announced a reform policy regarding the rights of traded shares, bearing the risk of decline in share price when non-negotiable shares are sold on the market. Non-negotiable shares were to not be traded during the twelve months after the reform is implemented. Even after the twelve-month lock-in period, holders of over 5% of shares in an enterprise were limited in terms of the number of shares they may sell at any one time. By July 2006, more than 1,000 listed firms, or 80% of all listed companies, adopted the reform.

The Chinese stock market has made positive strides in the past ten years, but there is still much work to be done in order for it to be comparable to that of mature markets such as those in the US or UK. On the positive side, sixty-five million Chinese have investment accounts today and are participating in the capital markets. The negatives, unfortunately, may trump the positive reports today. First, speculation is a huge problem in the Chinese stock markets. Individual investors are driven by a herd mentality and institutional investors routinely engage in speculation.

The Chinese market, therefore, does not reward investors for long-term investing. It is much more of a traders market. Furthermore, market segmentation is a barrier between China’s capital markets and international investors. Foreign investors can only trade class B shares, while domestic investors are able to trade both those and class A shares. Class B shares is composed of less than 10% of the number of class A shares and its total market value is only 2.4% of that of class A shares. The long-term performance of class B shares has lagged class A shares in the market as well. These are two issues requiring governmental reform in order for the Chinese markets to develop.

The banking sector in China has limited investment overseas. At the end of 2002, all of China’s commercial banks together have around 670 foreign branches, over 90% of which belong to the four largest state-owned commercial banks-known today as the ‘Big Four’. The Big Four state commercial banks are comprised of the following banks: the Industrial and Commercial Bank of China, the Bank of China, the China Construction Bank and the Agricultural Bank of China. These branches held $160 billion in assets and $156 billion in liabilities at the time. As of 2005, 111 Chinese firms were listed on exchanges overseas. One-hundred-and-eight were listed on the Hong Kong Stock Exchange (HKSE), thirteen were listed in the US, on the New York Stock Exchange (NYSE) and the National Association of Securities Dealers Automated Quotation (NASDAQ), three were listed in the U.K. and two in Singapore. Inefficiencies in the Chinese stock market can be attributed to poor and inefficient regulation. Using a buy-and-hold strategy from 1992 through 2003, the Shanghai Stock Exchange (SHSE) index underperformed the Standard and Poor’s 500 (S&P 500) index by 120%. This suggests that listed firms are among the low-quality firms in China.

The government bond market in China grew slower than the stock market, but between 1998 and 2002, the growth rate was 11.7%, with outstanding bonds reaching $232 billion. Corporate bonds, on the other hand, were only one-fifteenth the size of government bonds at the end of 2001. The Chinese bond market has slowly begun expanding in recent years, however, due to the growth in U.S.-based investment banking activity in the region.

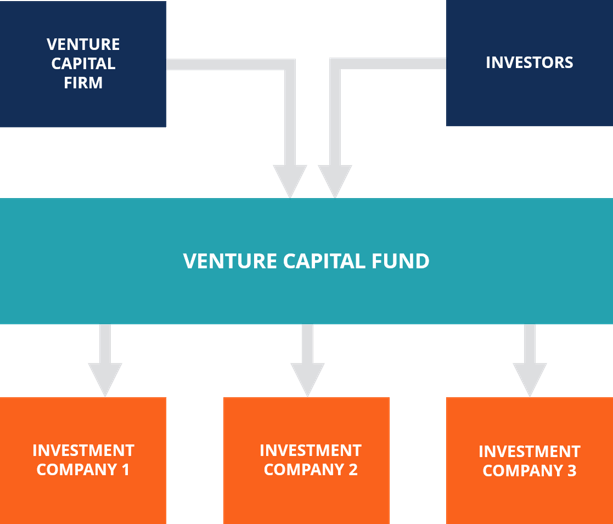

China’s venture capital industry has been underdeveloped since its inception in the 1980s. Its role in supporting the growth of young firms has been very limited. However, in recent years, China has become a central hub among emerging economies for private equity. China was ninth out of the top twenty countries in the world for receiving private equity investment in 2004, trailing Japan and South Korea among Asian countries, and has attracted $1.67 billion that year. Many venture capital companies are wholly foreign-owned and registered in tax havens such as the Cayman Islands for tax purposes. The exit strategies for venture capital firms include trade sales and initial public offerings (IPOs). Total gross proceedings raised in IPOs on the Chinese stock exchanges was $25.74 billion in 2006, just shy of the $32.05 billion raised in the U.S. market. In the same year, the Industrial and Commercial Bank of China, one of the Big Four, issued the world’s largest IPO. It raised $14 billion in Hong Kong and $5.1 billion on the SHSE.

The asset management business in China has grown tremendously in recent years. Wall Street firms have been buying into China’s fund management due to the fact that it has one of the most attractive segments of the financial services industry. Currently, there is an astonishing $1.7 trillion in Chinese personal savings. Assets under management have ballooned to about $60 billion by 2005, up from almost nothing a few years ago. In 2005, China had fifty-four closed-end and 164 open-end funds under the management of fifty-three fund management companies.

The Chinese government owns 99.45% of the ten largest commercial banks in China as of 1995. Competition is extremely low due to dominance of the Big Four. There is a risk of an impending banking crisis due to a severe level of non-performing loans (NPLs), which may be at over fifty percent as of 1999. To address NPLs, the Chinese government set up four state-owned asset management corporations (AMCs) in 1999. The purpose of the AMCs was to buy bad debt from the Big Four and dispose of them over a period of ten years. The Chinese Ministry of Finance (MoF) provided each AMC with an initial capital injection of $1.2 billion, making the MoF the sole owner of the AMCs. The AMCs were given three mandates: to maximize asset recovery, lesson the financial risks facing the Big Four and restructure China’s SOEs. Currently, however, cash recovery rates are expected to not exceed 20%. Financial market reform and development is a key priority in China.

[ad_2]

Source by David J Stone